Iowa Gambling Task Instructions

Fernie G, Tunney RJ: Some decks are better than others: the effect of reinforcer type and task instructions on learning in the Iowa Gambling Task. 2006, 60 (1): 94-102. Article PubMed Google Scholar.

The notice includes instructions on where and how to complete the annual report. The Social and Charitable Gambling Unit administers Iowa Code Chapter 99B, which regulates games of skill or chance, raffles, bingo, social gambling and amusement devices. Qualified organizations may obtain a social or charitable gambling license to conduct fund. Keywords: Iowa gambling task, reward–punishment, instructions, decision making, framing effect Introduction The somatic marker hypothesis (SMH) states that emotions are indispensible to long-term decision making (Damasio, 1994 ).

Gambling winnings are fully taxable in Iowa even if the winner is not an Iowa resident.

The gross receipts from almost all gambling activities conducted in Iowa are subject to state sales tax and local option sales tax, if any.

Individuals or groups conducting gambling activities must report and pay sales tax and local option tax, if any, on the gross receipts (not net receipts) of all gambling activities.

Most cities and rural areas of Iowa have the 1% local option sales tax in addition to the state sales tax. Local option sales tax applies if the event takes place in one of these jurisdictions. See Iowa Local Option Tax Information for more information and lists of jurisdictions that have local option sales tax.

Any individual or group conducting gambling activities in Iowa must:

- Obtain a gambling license from the Iowa Department of Inspections and Appeals

- Obtain a permanent sales tax permit from the Iowa Department of Revenue

Note: A gambling license may not be required for certain “very small raffles” (contact the Department of Inspections and Appeals for details). Even if a gambling license is not required for a “very small raffle,” Iowa sales tax is still due and the organizer must apply for a sales tax permit.

A portion of your winnings may have been withheld for taxes upon payment of your winnings by the person making the payment (i.e., the “payer,” such as a casino). According to state and federal laws, certain winnings are subject to withholding for income tax purposes. Winnings are subject to a 5% withholding rate for Iowa income tax purposes and a 24% withholding rate for federal income tax purposes.*

The withholding of state income tax from your winnings will not necessarily satisfy your Iowa tax responsibilities. You may be required to file an Iowa income tax return. You may also owe more state income tax than what was withheld, depending on different variables such as your total Iowa income or your total income from all sources. Only by completing the IA 1040 can the correct amount of Iowa tax be determined.

If the amount withheld exceeds the Iowa tax calculated on form IA 1040, you may be eligible for a refund of that portion of the tax withheld.

NOTE: Nonresidents are not exempt from Iowa tax or Iowa withholding and usually will not receive a full refund of the Iowa tax withheld.

* This guidance was updated on March 16, 2020. For the most up-to-date federal withholding rate, refer to section 3402(q) of the Internal Revenue Code.

What is subject to withholding:

- Lottery Winnings: Any payment of winnings greater than $600 is subject to withholding. This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa.

- Prizes (Games of skill, games of chance, bingo, or raffles): Any payment of a prize where the amount won exceeds $600 is subject to withholding.

- Parimutuel Winnings: Race track winnings more than $1,000 are subject to withholding.

- Slot Machines (River Boats & Racetracks): Withholding is required if winnings exceed $1,200 from slot machines.

What is exempt from withholding?

- American Indian Casinos: Winnings at Iowa American Indian casinos are not subject to withholding.

Note: winnings at Indian casinos by individuals other than American Indians are subject to Iowa income tax even though they aren't subject to withholding.

The gross receipts from almost all gambling activities conducted in Iowa are subject to state sales tax and local option sales tax, if any. Gambling activities conducted by churches and most charitable organizations are taxable. It does not matter how the proceeds are used.

The following gambling activities are exempt from sales and local option taxes:

- Activities conducted by county and city governments. (Iowa Code section 423.3(32)).

- Activities held by the Iowa State Fair, Iowa State Fair Authority, or Iowa State Fair Foundation (organized under Iowa Code chapter 173), including gambling activities that occur outside of the annual scheduled fair. (Iowa Code section 423.3(35)).

- Activities held by a fair (as defined in Iowa Code section 174.1(2)), including gambling activities that occur outside of scheduled fair. (Iowa Code section 423.3(23)).

- Raffles held by a licensed qualified organization at a fair as defined under Iowa Code section 99B.1 and pursuant to the requirements specified in Iowa Code section 99B.24. (Iowa Code section 423.3(62)).

- Raffles (whether or not they are conducted at a fair event) where the proceeds are used to provide educational scholarships by a qualifying organization representing veterans as defined in Iowa Code section 99B.27(1)(b). (Iowa Code section 423.3(97)).

Usually, tax is included in the price of the gambling activity. To determine the gross receipts on which the tax is based, the tax must be backed out of the total sales.

Example: A group sells raffle tickets for $1 each; the price includes sales tax. 1,000 tickets are sold and the prize cost is $200. The $200 cannot be deducted from the $1,000 before calculating the sales tax due. The state sales tax rate is 6%; in this example, there is a local option tax of 1% for a total of 7%. The group will divide the $1,000 by 1.07 = $934.58. Therefore, gross receipts from the raffle are $934.58 and the total sales tax due is $65.42. (If local option tax does not apply, the gross receipts are divided by 1.06.)

Filing Frequency

How often a sales tax return is filed depends on the estimated amount of sales tax that was entered on the Iowa Business Tax Registration form.

See Filing Frequencies and Return Due Dates.

Exemption for Purchase of Non-Cash Prizes

Property purchased for use as a prize to players in any game of skill, game of chance, raffle, or bingo game is not subject to Iowa sales tax. The winner of the prize is not obligated to pay the sales tax either.

This exemption includes the purchase of a motor vehicle subject to registration. Upon showing proof to the county treasurer that the vehicle was won, the one-time registration fee will not be charged.

Note: Winners of gift certificates must pay sales tax when they make purchases using the gift certificates.

Amusement Devices in Restaurants and Bars

Some restaurants and bars have amusement devices available for their customers to use.Iowa sales tax is due on the sales price from the operation of amusement devices (Iowa Administrative Rule 701-16.26). The tax is collected and remitted to the Department by the owner of the device.

- When the restaurant or bar owns the device, it must collect and remit the sales tax.

- When the device is not owned by the restaurant or bar, the owner of the device must collect and remit sales tax. The initial taxable transaction is between the device owner and the customer who puts money into the device. The restaurant or bar does not owe any sales tax on the amount of the proceeds given to it by the device owner. The sales tax collected and remitted by the device owner is based on the total sales price from the operation of the device, with no deduction allowed for any proceeds given to the restaurant or bar.

NOTE: The amusement device must clearly indicate sales tax is included in the amount required to use the device (Iowa Administrative Rule 701-212.1).

Taxability of Items Purchased with Tickets

When a customer uses a ticket from an amusement device to purchase an item at a discount, the item is subject to sales tax as follows:

- If the restaurant or bar is reimbursed for the discount by the owner of the device or any other person, sales tax is due on the original sales price of the item.

- If the restaurant or bar is not reimbursed for the discount, sales tax is due on the reduced price of the item.

Residents and Part-year Residents of Iowa

Winnings from all types of gambling, including charitable gambling, casinos, bingo, raffles, state lotteries, and dog and horse track betting, must be reported as 'Other Income' on line 14 on the IA 1040.

If you itemize, you may claim gambling losses as a miscellaneous deduction on Iowa Schedule A. However, this deduction cannot be more than your winnings. For example, if your gambling winnings for the year are $1,000, your deduction for gambling losses cannot exceed $1,000.

Taxpayers who claim the standard deduction on the Iowa return cannot deduct their gambling losses, although they must still report gambling winnings.

For step-by-step details on the process, see Gambling Winnings.

Nonresidents

Nonresidents are required to file an Iowa return if Iowa-source income, including gambling winnings, is $1,000 or more and gross income (from all sources, not just Iowa) is more than $9,000 if single or $13,500 for married filers. For step-by-step details on the process, see Nonresidents with Gambling Winnings.

Payers and Winners

Either payers or winners must pay withholding tax on gambling winnings. For details on this process in the case of noncash payments, see Winnings in the Form of Noncash Payments under How are Winnings Reported? below.

Winnings are fully taxable and, within limits, gambling losses are deductible.

Payers of winnings from horse racing, dog racing, bingo games, and lotteries must report winnings of more than $600 to the Internal Revenue Service and the Iowa Department of Revenue by filing form W-2G. Winnings of $1,200 or more from slot machines are reported on form W-2G.

The winner's name and Social Security Number are required on the W-2G form.

Taxpayers report their gambling winnings on the IA 1040. If federal tax is taken out of your winnings, you may claim a deduction for it on the 'federal income tax withheld' line on the IA 1040.

Even if your Iowa-source income is less than the amount required to file a return, you may want to file an Iowa return if Iowa tax has been withheld from your winnings. You may be eligible for a refund of the tax withheld on your winnings. You cannot receive a refund unless you file a return.

Can Losses be Deducted?

Gambling losses can be deducted up to the amount of winnings. If you itemize, you may claim gambling losses as a miscellaneous deduction on Schedule A. However, this deduction cannot be more than your winnings.

For example, if your gambling winnings for the year are $1,000, your deduction for gambling losses cannot exceed $1,000.

Taxpayers who claim the standard deduction on the Iowa return cannot deduct their gambling losses, although they must still report gambling winnings.

Out-of-state Winnings

Iowa residents who have winnings from gambling in another state may have to file an income tax return with the other state and pay tax on the winnings.

These winnings are also taxable to Iowa. However, the Iowa resident may claim an out-of-state tax credit on the IA 130 of the IA 1040 for the tax paid to the other state.

Winnings in the Form of Noncash Payments

Proceeds from gambling activities which are not money, such as a car in a sweepstakes, shall be taken into account at the fair market value (“FMV”) of the noncash payment for purposes of reporting and withholding. If the FMV exceeds $600, after deducting the price of the wager, the winnings are subject to a 5% Iowa withholding rate regardless of whether the prize is subject to federal withholding. Federal withholding is not required until the noncash payment exceeds $5,000, then the federal withholding rate of 24% also applies. The Iowa tax that must be withheld is computed and paid under either of the following two methods:

1. The winner pays the withholding tax to the payer. In this case, no adjustment to the noncash payment is necessary.

2. The payer pays the withholding tax. In this case, the value of the noncash payment must be increased to account for the withholding tax the payer pays. The withholding is calculated as follows:

- For noncash payments that exceed $600 but are not greater than $5,000, figure the value of the noncash payments as follows:

Noncash payment = (FMV of the noncash payment − the amount of the wager)/ (1 − Iowa income tax withholding percentage) - For noncash payments of $5,001 or more, figure the value of the noncash payments as follows:

Noncash payment = (FMV of the noncash payment − the amount of the wager)/(1 − (federal income tax withholding percentage + Iowa income tax withholding percentage))

NOTE: If you use the second method, enter the adjusted noncash payment amount in Box 1 of federal Form W-2G: Certain Gambling Winnings. Enter the federal withholding tax paid by the payer in Box 4, and the state income tax withholding paid by the payer in Box 15. State winnings reported in Box 14 will be the same as Box 1.

Example 1: In 2020, Taxpayer A pays $10 for a raffle ticket and wins a television with a FMV of $1,010. The first step is to calculate the net winnings which will equal the FMV of the noncash payment minus the amount of the wager, or ($1,010 − $10) = $1,000. The next step is to calculate the income tax withholding, which is computed under either of the following methods:

- The winner pays the withholding tax to the payer. Taxpayer A must pay the payer $50 of Iowa income tax withholding ($1,000 × 5%). The payer must timely remit the income tax withholding. Taxpayer A will receive a W-2G reporting $1,000 of winnings and Iowa withholding of $50. Taxpayer A will not have any federal income tax withholding because A’s net winnings do not exceed $5,000.

- The payer pays the withholding tax. In this case, calculate the adjusted noncash payment.

Noncash payment = (FMV of the noncash payment − the amount of the wager)/(1 − Iowa income tax withholding percentage)

Noncash payment = ($1,010 − $10)/(1 − 0.05)

Noncash payment = $1,000/0.95

Noncash payment = $1,052.63

Iowa withholding = (noncash payment × Iowa income tax withholding percentage) = ($1,052.63 × 5%) = $53 (Rounded)

Taxpayer A will receive a W-2G for reporting $1,052.63 of winnings and Iowa withholding of $53. Taxpayer A will not have any federal income tax withholding because A’s net winnings do not exceed $5,000.

Example 2: In 2020, Taxpayer B pays $100 for a raffle ticket and wins a motorcycle with a FMV of $10,100. The first step is to calculate the net winnings which will equal the FMV of the noncash payment minus the amount of the wager, or ($10,100 − $100) = $10,000. The next step is to calculate the income tax withholding, which is computed under either of the following methods:

- The winner pays the withholding tax to the payer. Taxpayer B must pay the payer $2,400 of federal income tax withholding ($10,000 × 24%) and $500 of Iowa income tax withholding ($10,000 × 5%) for a total of $2,900. The payer must timely remit the total income tax withholding. Taxpayer B will receive a W-2G reporting $10,000 of winnings, federal withholding of $2,400, and Iowa withholding of $500.

- The payer pays the withholding tax. In this case, calculate the amount of the adjusted noncash payment.

Noncash payment = (FMV of the noncash payment − the amount of the wager)/(1 − (federal income tax withholding percentage + Iowa income tax withholding percentage))

Noncash payment = ($10,100 − $100)/(1 − (0.24 + 0.05))

Noncash payment = $10,000/(1 − 0.29)

Noncash payment = $10,000/0.71

Noncash payment = $14,084.51

Iowa withholding = (noncash payment × Iowa income tax withholding percentage) = ($14,084.51 × 5%) = $704 (Rounded)

Federal withholding = (noncash payment × federal income tax withholding percentage) = ($14,084.51 × 24%) = $3,380.28 (Rounded)

Taxpayer B will receive a W-2G for reporting $14,084.51 of winnings, federal withholding of $3,380.28, and Iowa withholding of $704.

Keeping Records

An accurate diary or similar record of gambling winnings and losses must be kept along with tickets, receipts, canceled checks, and other documentation. These supporting records do not need to be sent in with your tax return, but should be retained in case of an audit.

See Federal Publication 529 for more information.

- For noncash payments that exceed $600 but are not greater than $5,000, figure the value of the noncash payments as follows:

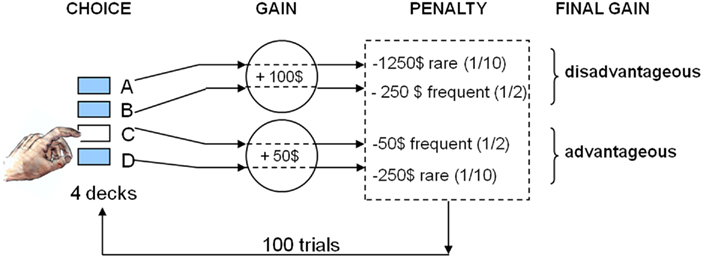

How is the Task Structured?

The Iowa Gambling Task is an incredibly simple test. The participant is presented with four virtual decks of cards if playing on a computer, or four real decks if doing the test in the physical domain. The participant is informed that the outcome of each choice, that being which deck they choose to draw a card from, will reward or penalize them. The aim of the game is to raise as much money as possible through maximizing the rewards and minimizing the number of penalties incurred. After several plays on each deck the participant should understand and form an intuition of how to proceed in the game. The key here is that you must use this specific set up for the test. However, you can notice the patterns of behavior while playing online blackjack or playing roulette.

Common Findings Upon Completion of the Task

The majority of participants sample a few cards from each deck to gain an understanding of the game mechanics. Once an intuition has been developed, usually at about 20-30 selections into the game, the player is generally very good at selecting the cards from the decks that will most efficiently build their reward/bank balance in the game. However, the test is designed to identify patients with an orbitofrontal cortex dysfunction (OFCD). In the case a patient playing the Iowa Gambling Test has an OFCD, the likeliness is they will fail to recognize the decks that reward them the most efficient and will continue to persevere with bad decks. Furthermore, researchers are able to monitor the reaction time of each choice on the player. Healthy patients are witnessed as displaying a stress reaction to hovering over bad decks, even after just 10 selections into the game. By contrast, players with neurological dysfunctions continue to choose outcomes that yield high immediate rewards in spite of higher losses in the future.

Bechara and Damasio explain these findings in great detail. The key conclusion relates to the somatic marker hypothesis, which ascertains that key decision making is often made in the heat of emotions and it is emotions that ultimately guide behavior and decision making. This obviously has particular relevance to gambling psychology which we will attempt to bring into the equation in the following section. If you want a quick break from the dense psychological analysis, have a read of this relatable article on how gamblers try to get good luck.

Can the Iowa Gambling Task Identify Gambling Addiction?

It seems like a very logical conclusion to make given the results of healthy and dysfunctional patients. The apparent inability to recognize risk whilst making a decision, and being blinded by the potential to yield larger immediate gains is a familiar problem to anyone who understands gambling addiction. Participants who are constantly choosing a deck that will yield higher gains but comes with a much higher chance of a high penalty are more likely to become gambling addicts. Players who recognize that small incremental gains at a low-risk desk are better for them in the long-run are less likely to be gambling addicts. This simple hypothesis has become the foundation of this test and remains a large reason why it is attributed to pushing advancements in the assistance of gambling addiction.

What Other Lessons Can We Learn from the Iowa Gambling Test

Whilst the conclusions drawn from the Iowa Gambling test is indeed very fascinating, they are by no means the limit of this psychological phenomenon. The test itself can be used to extrapolate many conclusions about the process of human decision making. Below we have selected some of the most interesting conclusions found by studies of the Iowa Gambling Test. In particular, there is a fundamental need to explain the connection between emotion and decision-making.

- Gain and loss frequency are in fact the most crucial features of a gambling game when determining which one to choose. Subjects in the Iowa Gambling Test who are of a healthy pre-disposition were increasingly more likely to choose the deck that gave the most wins, despite the size of the reward.

- Having the ability to memorize stuff and rules lead to favorable decision making. Subjects who are able to work something out, and at the same time remember crucial details about a task were far more likely to succeed in the Iowa Gambling Task.

- Participants who take fewer drugs either medication or recreational performed far better under the pressure of the Iowa Gambling Task. It is well-known that recreational drug use has an adverse effect on the psychology of the individual. With this in mind, it explains a lot of the detrimental connections between drugs and gambling addiction.

- Anxiety and other mental conditions of a similar nature tend to cause a negative impact on our ability to make good decisions. With the pressure of reward and risk, participants with high-anxiety are often likely to avoid risk all together at all costs. This can lead to a high opportunity cost from missing out on potential gains.

A Few Final Words

The Iowa Gambling Task is by all measures a fascinating concept and study of the human decision-making process. The results gained from such a study can indeed be utilized and deployed to better understand gambling addiction and greater mysteries around the human psyche. For more wonderful reports on psychology in gambling, check out our article on the Gamblers Fallacy. If you think that you may be developing or already have unhealthy attitudes while gambling, read our guide to responsible gambling.

Iowa Gambling Task Professional Manual

You can find out more about the Iowa Gambling Task here.